DebtDefend's Official Blog

The Authoritative Destination for DebtDefend News, Promotions, Education, and More.

Debt counseling is a professional service that can help individuals and families manage their debt and improve their financial situation. Debt counselors provide guidance, support, and strategies to help people overcome debt and achieve financial stability.

Nebraska, like many states, has laws in place to regulate debt collection practices and provide protections for consumers. Understanding these laws can help individuals navigate financial difficulties and avoid potential pitfalls.

Washington state, known for its stunning natural beauty and progressive policies, also has specific laws governing debt and collections. Understanding these laws can be crucial for both creditors and debtors, particularly those involved in business or financial transactions within the state.

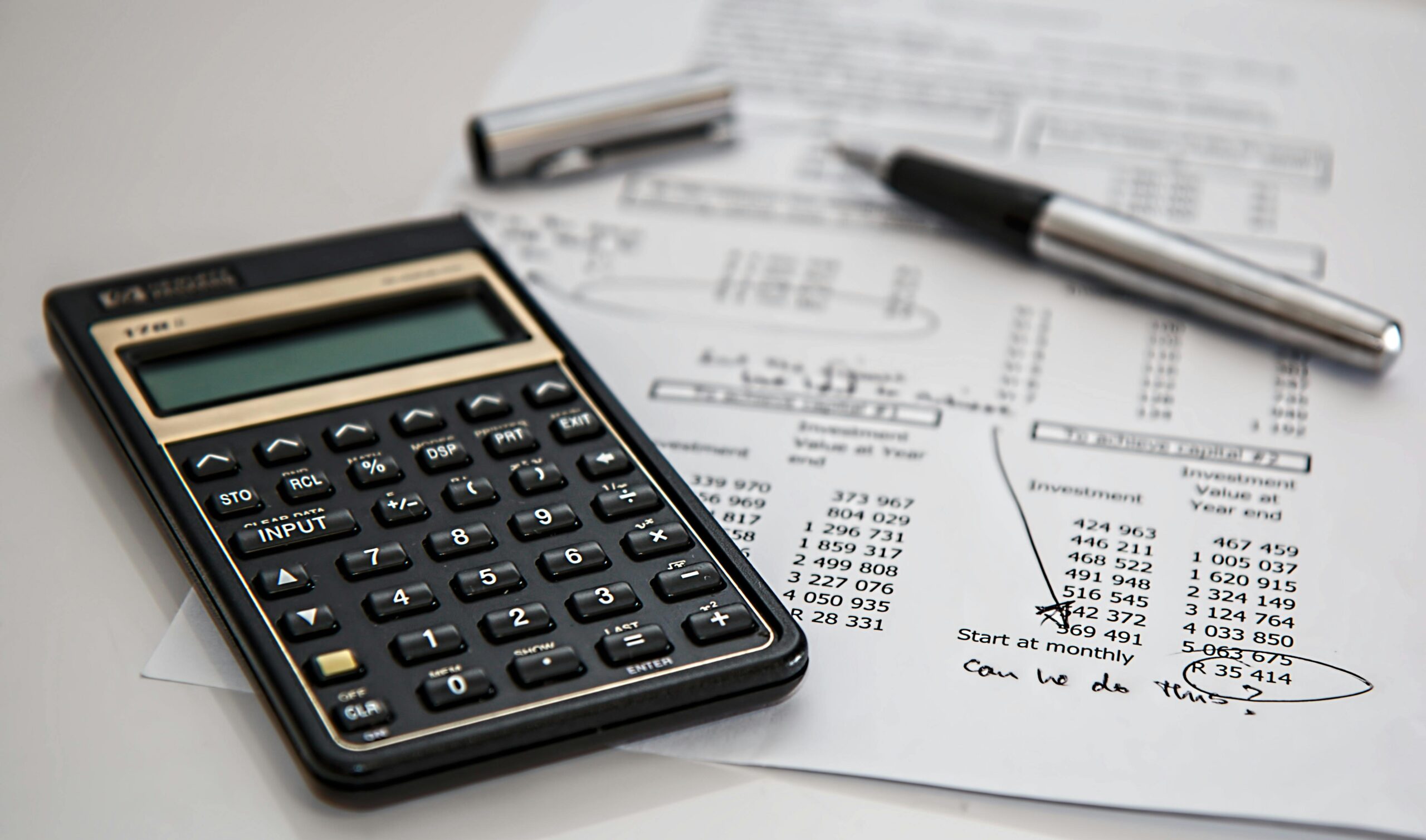

Personal loans are a type of loan that can be used for various purposes, including home improvements, medical expenses, debt consolidation, or simply to cover unexpected costs. They offer a flexible way to borrow money, but it's essential to understand how they work and the potential consequences of defaulting on payments.

The statute of limitations is a legal time limit within which a creditor can sue a debtor to collect on a debt. This time limit varies depending on the type of debt and the state's laws. Once the statute of limitations expires, the creditor generally cannot sue to collect the debt. However, it's important to note that while the creditor may be barred from filing a lawsuit, the debt itself is not necessarily forgiven.

Identity theft is a growing concern in today's digital age. When someone steals your personal information, they can use it to open new accounts, make purchases, and even commit crimes. If you've been a victim of identity theft, it's important to take immediate action to protect yourself and repair your credit.

Subordinated debt is a type of debt that ranks lower in priority for repayment than other forms of debt. In the event of a company's bankruptcy or liquidation, subordinated debt holders are typically paid after senior debt holders, such as bondholders and secured lenders.

Bankruptcy can be a powerful tool for individuals and businesses overwhelmed by debt. However, when it comes to tax debt, the situation is more complex. While bankruptcy can provide relief from certain types of debt, its effectiveness in clearing tax debt depends on several factors.

A charge-off occurs when a creditor determines that a debt is unlikely to be repaid. This typically happens after repeated attempts to collect on the debt have been unsuccessful. While a charge-off can be a significant financial setback, it's important to understand what it means and how to recover from it.