DebtDefend's Official Blog

The Authoritative Destination for DebtDefend News, Promotions, Education, and More.

New York Attorney General Letitia James filed a lawsuit against Citibank, N.A. (Citi) in January 2024, accusing the bank of failing to adequately protect customers from fraud and improperly handling reimbursement claims. The lawsuit alleges Citi's practices violate the Electronic Fund Transfer Act (EFTA) and leave New York residents vulnerable to financial losses.

Debt collection can be a stressful experience, and sometimes, collectors may resort to aggressive tactics. However, the Fair Debt Collection Practices Act (FDCPA) safeguards consumers with regulations that limit how collectors can contact them. One crucial provision is the "7 in 7 rule," which prevents excessive phone calls and harassment.

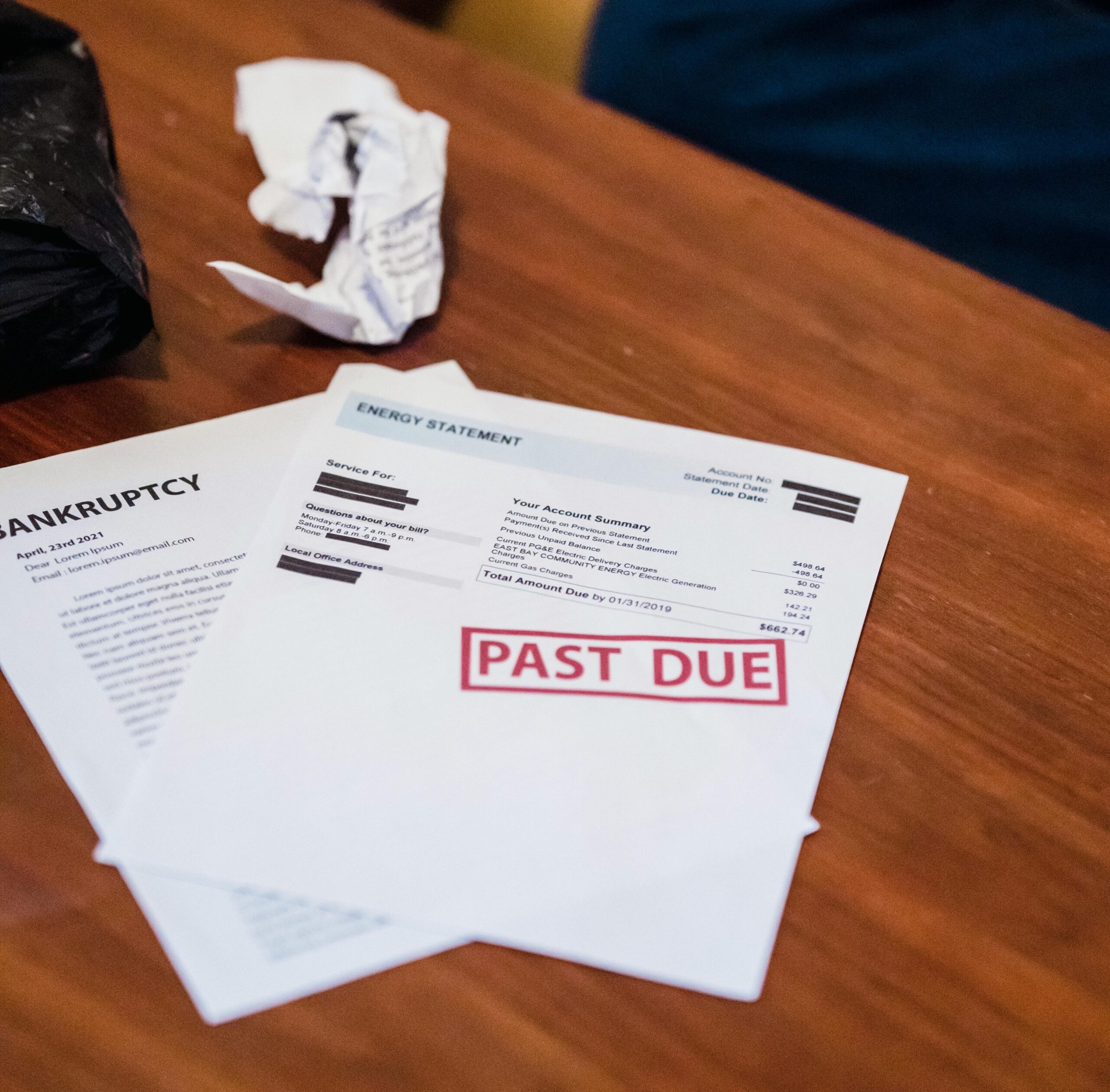

Debt can feel like a tidal wave, pulling you under and threatening to drown you financially. For many Americans facing overwhelming debt burdens, bankruptcy emerges as a potential lifeline. This legal process offers a fresh start, allowing individuals to restructure their finances and achieve long-term financial stability. However, navigating the different types of bankruptcy – Chapter 7 and Chapter 13 – can be confusing. Understanding the key differences and implications is crucial for making informed choices.

Imagine facing a lawsuit and losing. The emotional toll is significant, but in Florida, the financial repercussions can linger for far longer than you might expect. A judgment against you can remain enforceable – meaning creditors can take legal action to collect the debt – for up to 20 years. But the story doesn't end there. Florida law allows creditors to renew judgments, potentially extending their reach indefinitely. Understanding how judgments work and your options for navigating them is crucial for protecting your financial future.

Debt management is a critical aspect of financial health, and understanding the laws that govern debt collection is crucial for consumers. Maine has specific regulations that outline how debt collection should be conducted and provide protections for consumers. This article delves into the essential aspects of debt laws in Maine and highlights valuable resources available to residents.

Losing a lawsuit can be a devastating blow, not just emotionally, but also financially. In California, the repercussions can extend beyond the initial judgment amount. A judgment lien, a legal claim placed on your property, can give creditors significant rights over your assets for a surprisingly long time. Understanding judgment liens and your options is crucial for navigating this complex situation.

New Yorkers can finally breathe a sigh of relief – medical debt will no longer be included in their credit reports. This long-awaited change, signed into law by Governor Kathy Hochul in December 2023, is a major victory for consumer advocates and a significant step towards financial wellness for millions of residents. However, experts warn that this positive development might have an unintended consequence: a potential rise in lawsuits by debt collectors.

Managing debt can be challenging, but understanding the laws that regulate debt collection can significantly ease the process. In Kansas, specific statutes govern how debt collection is handled and provide protections for consumers. This article outlines the essential aspects of debt laws in Kansas and offers valuable resources for residents seeking assistance.

Debt can be a daunting issue, and understanding the laws surrounding it is crucial for managing and resolving financial obligations effectively. Indiana, like many states, has specific laws that govern debt collection and provide protections for consumers. This article outlines the key aspects of debt laws in Indiana and highlights important resources for residents.