DebtDefend's Official Blog

The Authoritative Destination for DebtDefend News, Promotions, Education, and More.

Navigating the legal system can be a daunting and expensive task, especially for those who cannot afford an attorney. Fortunately, for Texans seeking legal assistance or guidance, TexasLawHelp.org serves as an invaluable resource. This nonprofit website provides free, reliable legal information, including comprehensive guides, court forms, checklists, and instructions to help individuals handle a wide range of legal issues. Whether dealing with family law matters, housing problems, consumer issues, or public benefits, Texans can turn to TexasLawHelp.org for support in understanding their rights and options.

Dealing with debt collectors can be a stressful and intimidating experience. Whether you’ve fallen behind on bills or are facing a collection for a disputed debt, it’s important to know your rights. In California, consumers have special protections under the Rosenthal Fair Debt Collection Practices Act (RFDCPA), a state law designed to prevent abusive debt collection practices and ensure fair treatment of debtors.

Dealing with debt can feel overwhelming, but knowing your rights and the legal protections available in New Jersey can make a significant difference in managing your financial situation. Whether you’re facing issues with credit cards, medical bills, or other types of debt, this article will provide an overview of New Jersey’s debt laws and resources to help you regain control of your finances.

Debt issues can lead to significant financial and emotional strain. Whether your debt arises from credit cards, medical bills, or personal loans, it is essential to know how to handle it and understand your rights under Pennsylvania law. This article explores common debt issues, relevant Pennsylvania laws, and resources available to assist individuals in overcoming debt challenges.

Rent Recovery Solutions (RRS) is a debt collection agency that specializes in collecting unpaid rental debts. If a tenant has outstanding rent, fees, or charges after moving out of a rental property, landlords or property management companies may turn the debt over to Rent Recovery Solutions. The company then attempts to collect on the debt, and in some cases, may initiate legal action in the form of a lawsuit against the tenant to recover the funds. Being served with a lawsuit from Rent Recovery Solutions can be overwhelming, but understanding the process and your options is essential to defending your rights.

Navigating the legal system can be an overwhelming and expensive process, particularly for individuals and families who are already struggling to make ends meet. In Central Florida, many residents face legal challenges that impact their housing, employment, family relationships, and access to essential services. For those earning less than 125% of the federal poverty income guidelines, the barriers to obtaining legal assistance can seem insurmountable.

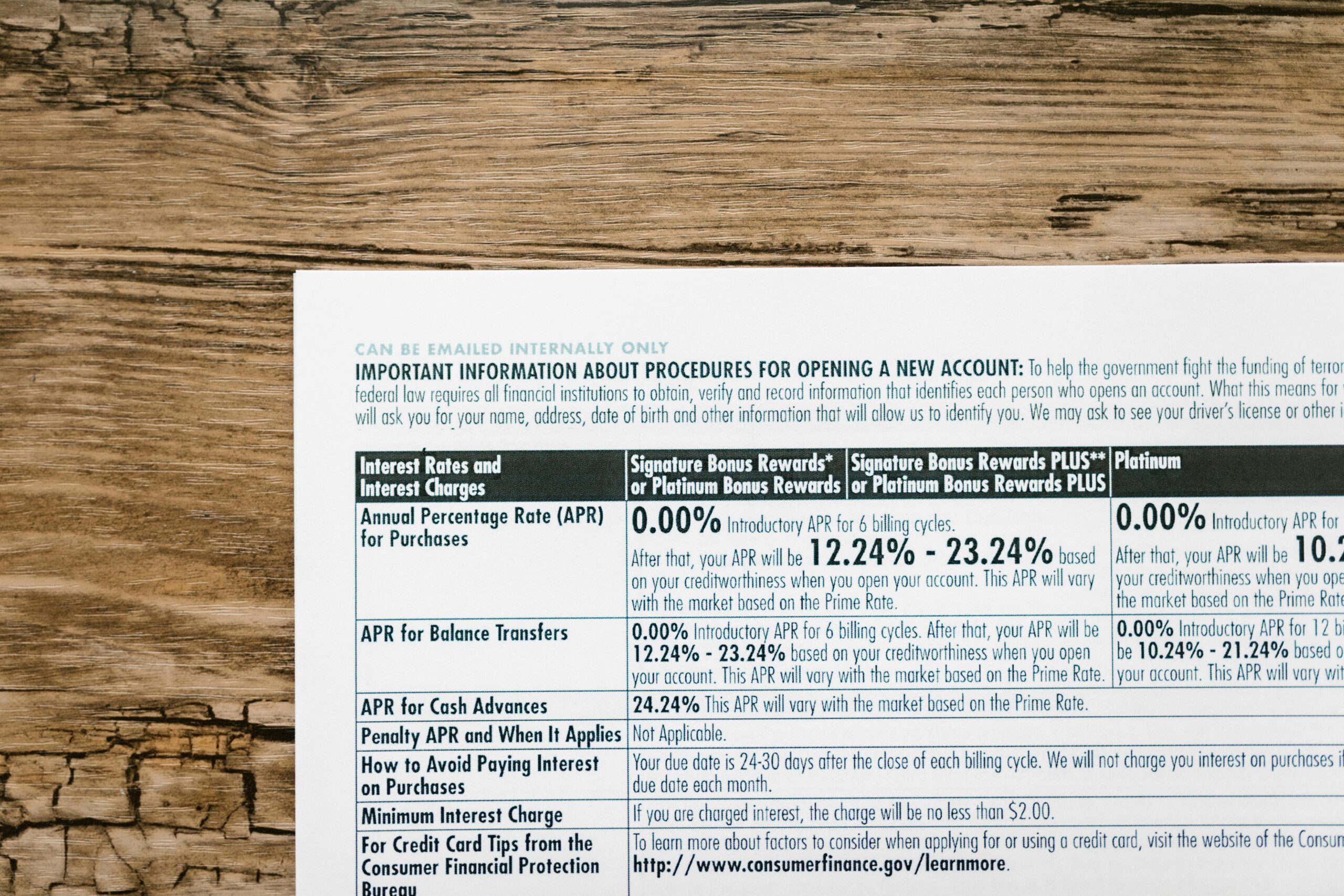

A charge-off is a term used in the financial world to describe a situation in which a creditor, such as a bank or credit card company, has given up on collecting a debt after a period of non-payment, usually around 180 days. When this happens, the creditor "charges off" the debt as a loss in their accounting records, which essentially means they don’t expect to recover the money. However, this does not mean the debt goes away for the borrower.

Debt issues can create significant stress and financial instability. Whether it stems from credit card debt, medical bills, personal loans, or student loans, managing debt is crucial for maintaining financial health. In Wyoming, understanding the relevant debt-related laws and resources can help you address these challenges effectively. This article explores common debt issues, relevant Wyoming laws, and available resources to assist individuals dealing with debt.

Debt issues can weigh heavily on individuals and families, often leading to significant stress and financial strain. In Minnesota, as in other states, there are specific laws and resources designed to help residents manage and overcome debt-related problems. This article provides an overview of debt issues, relevant laws in Minnesota, and resources for assistance.